Taku Luxentis:

Unlock Crypto Education Pathways with Taku Luxentis

Sign up now

Sign up now

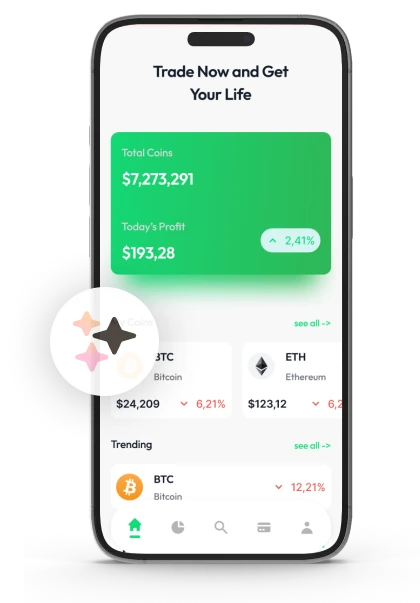

Taku Luxentis acts as a connector, linking those interested in learning about investment in digital assets to educational firms. The site doesn’t provide lessons or personal advice. Instead, it helps users find firms that explain the complexities of crypto market cycles. Its purpose is to help users make informed decisions by matching them with educational options that best align with their learning styles and goals.

To begin, users submit their contact details, allowing educational firms to reach out with information about their services, teaching approaches, and views on the market. Taku Luxentis does not assess, rank, or recommend any of the content. The site does not evaluate the effectiveness of the educational resources offered.

By serving purely as a connector, Taku Luxentis remains impartial in the investment education landscape. Users are in charge of deciding if the materials they receive align with their personal learning objectives. Remember, while education can guide your decisions, cryptocurrency markets are volatile, and losses are always a risk.

Investment education is widely regarded as a means to help individuals understand the inner workings of financial markets. Rather than providing direct guidance or tips, these programs primarily aim to explain key financial terms, concepts, and past market behaviors. Such learning is valuable for navigating markets that can be highly volatile and influenced by numerous external forces.

Through exposure to educational content, people can better recognize the relationships between market events, data reports, and price changes. While education doesn’t eliminate uncertainty, it helps users form more structured questions when analyzing market trends. Educators typically focus on explaining patterns, risks, and the limitations of past data rather than predicting future outcomes.

Investment education doesn’t eliminate the risks associated with the markets or ensure perfect decision making. The market is still affected by unexpected events, changes in sentiment, and fluctuations in liquidity. The value of educational content depends heavily on how individuals interact with and assess the information. It’s crucial to understand that no educational framework can guarantee success or shield from market unpredictability.

Taku Luxentis is more like a switchboard than a classroom. While markets fluctuate, the site maintains a steady process. People come with questions, and educators receive signals of interest. The site doesn’t provide lessons directly. Think of it like a railway station: trains come from various locations, and passengers pick their route. The site doesn’t control the train’s direction, just like Taku Luxentis doesn’t steer the learning journey. Its role is to create a calm structure for educational conversations to begin without pressure.

Registration is the first step toward opening an educational conversation. It’s brief and simple, no lessons or advice are given at this point. The purpose is just to create a communication channel. Users enter basic contact information: their full name to identify the request, an email for written responses, and a phone number in case a follow up is needed. Think of it like checking in at a seminar or event. The goal is to start a connection, nothing more.

The registration process asks for only a few necessary details. These details help educators reach out promptly and without confusion. Skipping or rushing through this step can lead to mistakes or delays. When you take the time to enter correct and complete information, the process works much more smoothly. Slow starts often lead to better outcomes than rushing through and missing key context.

Registration doesn’t unlock any lessons or provide financial advice. It doesn’t rank or select educators either. Its sole purpose is to make initial contact possible. Once the communication begins, individuals can decide whether to continue the conversation. Asking questions, doing your own research, and speaking with financial experts is essential when making decisions in the volatile world of cryptocurrency. The risks of losses are real, and education is a crucial tool to help navigate them.

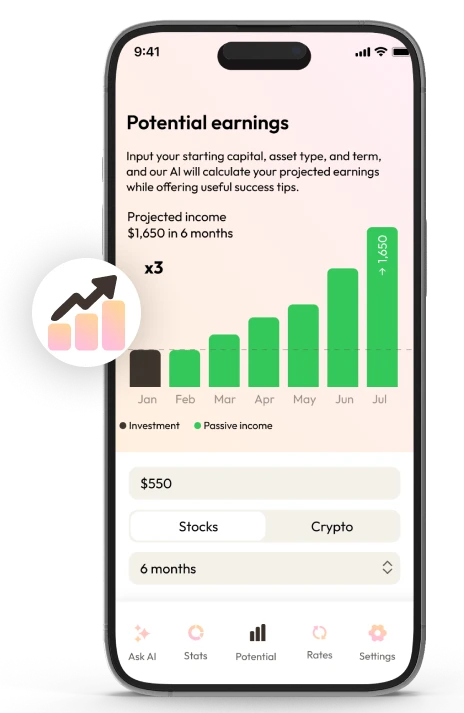

With prices fluctuating and headlines blaring, it’s easy to feel overwhelmed. Education helps slow down that rush, explaining how markets usually move in cycles, not straight lines. Take the tech stock boom of 2000. Prices shot up, then crashed. Many were left stunned, but looking back, the signs were there. Markets tend to repeat themselves, just with different players and circumstances.

Education emphasizes structure by putting smaller moves in the context of broader trends. When we zoom out, short term panic fades. This doesn’t remove risk, but it provides a clearer framework for understanding it. For example, in March 2020, when markets tanked, fear spread quickly, but data took longer to follow. Those familiar with past downturns were able to stay calm. Structured thinking works like a seatbelt, it helps you hold steady during volatile times.

Market behavior repeats because human behavior doesn’t change much. Emotions like fear, hope, greed, and relief continue to shape price trends. Through education, you start to recognize these emotions in past market cycles. Charts from the 1970s, 2008, and 2022 all show similar patterns of growth and decline. Expansion comes after contraction, and confidence always fades before a downturn. Rather than trying to predict the future, it’s more useful to understand why these patterns keep showing up.

Learning never stops. Markets evolve, tools change, but human reactions remain constant. Ongoing study helps you keep a steady perspective as things shift. Regularly exploring new research, hearing diverse viewpoints, and consulting financial experts is crucial. This balanced approach helps ensure that your decisions are well informed, no matter the market conditions.

Investment education helps organize facts and events. A single headline can feel meaningless on its own, but when placed in context, it becomes clearer. Education teaches how individual events connect over time, giving you a fuller picture. For instance, one policy change might seem insignificant, but its effects can unfold over months. Education shows why fear tends to spread faster than calm thinking during market turbulence. Instead of reacting impulsively, education helps you replace panic with patterns and noise with order. It’s like tuning out the distractions to focus on what truly matters. While education doesn’t promise success, it certainly helps you better understand the market's rhythm.

Most lessons show how markets move in phases, not straight lines. Phases like accumulation, slowdowns, and imbalances show up over and over again, even when the news changes.

Educators often point out that early signs are quiet, low volume, tight price ranges, and minimal excitement. The market usually starts off whispering, before raising its voice later.

Looking at these patterns over time helps students place short term moves into a larger context. Education isn’t about predicting the future but rather helping you ask better questions and observe the market more calmly.

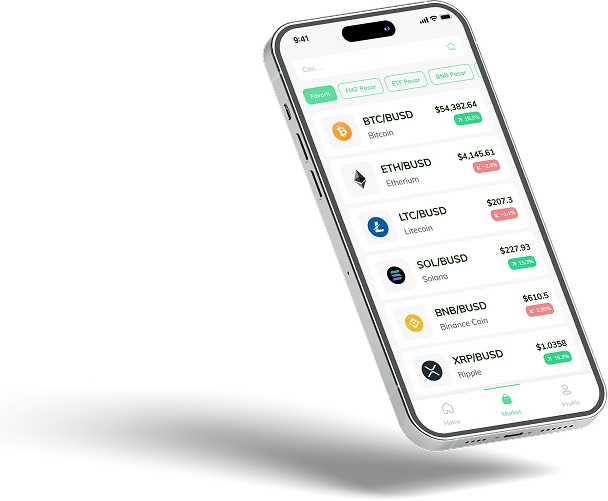

The design of Taku Luxentis helps maintain clear communication, even as market conditions change. The platform doesn’t offer lessons or advice. Instead, it focuses on providing organized access and steady coordination.

Imagine it as an airport control tower. While planes are always in motion, the tower doesn’t fly them, it simply prevents chaos by keeping everything on track.

Taku Luxentis employs a clear system to manage how requests flow through. Information enters, signals are directed accurately, and educators receive inquiries without distortion or favoritism. This layout is especially important in volatile times like 2022 when market prices changed dramatically in short periods. The clear structure reduced confusion, much like how a map helps guide you when navigating unfamiliar roads.

Short term market fluctuations often steal attention, but longer term trends are the real story. Taku Luxentis ensures a steady and consistent communication flow, allowing conversations to continue uninterrupted, regardless of changing market conditions. This consistency gives users the time to engage at their own pace. No pressure, no rush, just a measured approach to learning and decision making.

Instead of focusing on rapid, unpredictable movements, lessons explore how markets evolve in phases, accumulation, slowdown, and imbalance. These patterns often repeat, even if the headlines change from day to day.

By separating access from education, the site helps keep expectations clear. This structure allows conversations to stay on track and reduces confusion. Research is still key, asking the right questions, comparing different viewpoints, and consulting financial professionals before making decisions all contribute to maintaining balance.

Investment education illuminates concepts, but it doesn’t guarantee success. Gaining knowledge doesn’t assure accuracy, prosperity, or positive outcomes. Market movements are driven by various elements, such as emotions, policy changes, and unforeseen events.

Learning provides perspective, not foresight. Two people can absorb the same information yet arrive at entirely different conclusions. It helps to sharpen understanding, but not predict the future.

Educational conversations are rooted in concepts, patterns, and historical trends. They don’t eliminate uncertainty or control the direction of future markets. The outcomes always depend on individual choices and outside factors.

Market activity is often understood through education first, not immediate action. Shifts in behavior can show up early, even before the numbers catch up. Educational conversations help clarify why market momentum, pauses, and sentiment often unfold in stages.

Taku Luxentis plays a role in this learning process by acting as a bridge between those interested in investment education and independent educators. This connection allows users to explore how different phases of the market are studied, without receiving any direct advice or guidance on how to act.

Registration is a required step to facilitate this connection. Users must enter their full name, email, and phone number to allow educators to get in touch. There are no educational materials provided during this process. The purpose is simply to enable contact.

Education doesn’t directly change markets; it’s markets that change people. Education alters how people react. It slows down decisions, helps frame risk, and challenges assumptions when prices are moving quickly.

History has shown us this before. In 2008, access to knowledge didn’t prevent losses, but it helped some avoid panicking and selling. In 2020, education didn’t predict the crash, but it encouraged some to pause instead of chasing the market’s noise. Education doesn’t win the game, but it reduces costly mistakes.

When sharing personal details like your name, email, and phone number, security is essential. Any system that handles this kind of information needs strict safeguards. Proper data handling helps prevent misuse and makes communication clearer.

Think of it like locking your front door before leaving the house. It won’t stop every possible threat, but it does reduce unnecessary exposure. Security might seem like something to think about later, but when something goes wrong, you realize just how important it really is.

At registration, your information is used only to connect you with educators. Your details won’t be sold or shared publicly. The purpose is straightforward: to facilitate direct communication. By setting clear boundaries around your data, we help keep the conversation focused on learning, not privacy concerns. However, always be cautious. It’s important to know exactly what you’re sharing.

Taku Luxentis doesn’t host educational content directly. Instead, educators share their insights through one on one communication. These discussions often cover market history, risk management, and behavioral trends. For example, they might explore how the market behaved in 2008, 2017, or 2022. However, specific predictions aren’t made, after all, markets, like people, don’t follow a strict schedule.

Educational content varies depending on the educator. Some focus on long term trends, while others zoom in on short term movements. Comparing these perspectives helps deepen your understanding. But remember, independent research is key. Always ask questions, challenge your assumptions, and consult financial professionals before making decisions. The more knowledge you gather, the better.

Security also depends on the choices you make. Only share what’s necessary to keep communication clear. Read messages carefully, and don’t hesitate to ask direct questions to avoid misunderstandings during educational exchanges. It’s like lending a book, what matters is not just the content, but also who you lend it to. Trust builds faster when expectations are simple and clear.

A true understanding of the market comes from observing trends over time, not reacting to every sudden change. Taku Luxentis supports this broader perspective by providing steady access, even when the market is shifting. This helps users stay focused on meaningful educational discussions, instead of being distracted by short term fluctuations.

Imagine watching traffic from a hill, not from the middle of a busy intersection. From above, you start to see patterns, and what initially seemed chaotic begins to make sense. Sometimes, stepping back offers the clarity needed, even when things appear overwhelming up close.

Getting in touch with educators is easy with a quick registration process. Just provide your full name, email, and phone number, and you’ll be all set. These details help educators reach you directly. No lessons or advice are given at this stage, think of it like picking up a visitor badge before you enter a conference.

Education won’t make emotions disappear, but it helps you recognize them. It shows why fear tends to spike when markets fall and why confidence rises when prices climb. This understanding can slow your reactions, even if emotions still play a part in the decision making process.

Taku Luxentis is all about connecting people with the right educators for investment education. It doesn’t offer lessons or advice itself; it simply coordinates the connections. Imagine it as a notice board in a library, guiding you to the right resources without making any judgments.

| 🤖 Joining Cost | No fees for registration |

| 💰 Operational Fees | No costs whatsoever |

| 📋 Registration Simplicity | Registration is quick and uncomplicated |

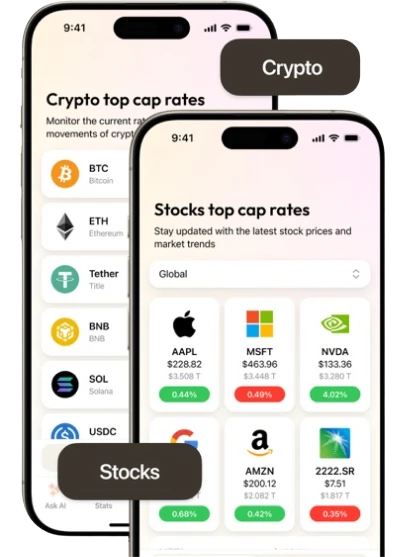

| 📊 Focus of Education | Lessons on Cryptocurrencies, Forex Trading, and Investments |

| 🌎 Countries Covered | Excludes the USA, covers most other countries |